Understanding the Sporting Goods Shopper’s Purchase Journey

- December 13, 2016

- By Randall Mueller

- Research

Despite the rise of online retailing, brick-and-mortar sporting goods stores still fill a welcome, important and needed role for the sporting goods shopper. That’s only one of many insights gleaned from “Shopper Playbook: Insights into the Sporting Goods Shopper,” an extensive study recently published by the National Association of Sporting Goods Retailers.

Whether you are on the giving or receiving end of the directive to “generate more growth,” understanding the shopper’s “purchase journey … is a critical underpinning for identifying potential growth opportunities” the report states.

NSGA’s extensive study explored the attitudes and behaviors of 1,600 sporting goods shoppers, along with 3,600 in-store observations.

Here, we’ll take a look at some of the takeaways from studying the planning stage of consumers’ purchase decisions. Then, in future posts we’ll look at additional data regarding decision-making and purchases.

The Planned Purchase cycle consists of:

1. Planning

2. Shopping, which includes browsing in addition to searching for the specific product.

3. Purchase

4. Post-purchase perceptions, which play into future potential purchases.

Further, there are three types of purchases:

1. Planned, in which buying an item is one of the reasons to go to a store or website.

2. Functional Unplanned, where something is seen in the store on or on a website and it reminded the consumer of the need or want for this item.

3. Impulse, a purchase the consumer didn’t think about before, but saw it and wanted it.

A key shopper behavior the study focused on was how consumers review purchase options early in their purchase journey. Leading up to planned or functional unplanned purchases, 63% of shoppers research products prior to purchasing. The study revealed that 67% of athletic equipment shoppers perform pre-purchase research, followed by footwear at 59%. Apparel is the least researched (45%).

Additional variables included whether a product was planned to be purchase online, in which case 80% of buyers research before purchasing; products costing more than $100 (78% research before buying); and shoppers under the age of 35 (72% in this category research before purchasing).

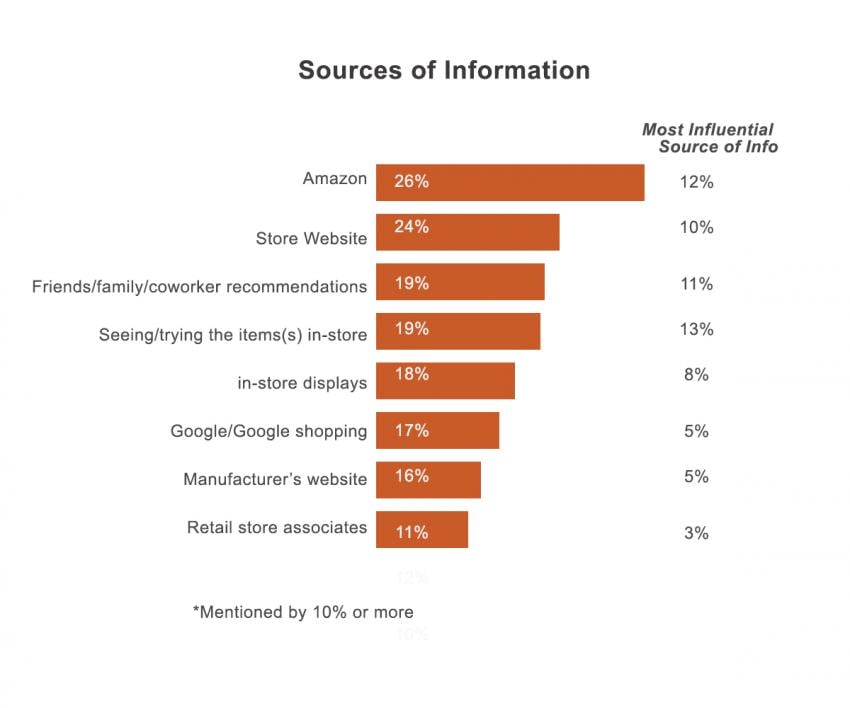

As shown below, while no individual source of research information is overly dominant, study results showed that Amazon and store websites are among the most utilized and influential sources. Also, more sources of information tned to be accessed when products over $100 are being purchased and when the purchaser is younger in age.

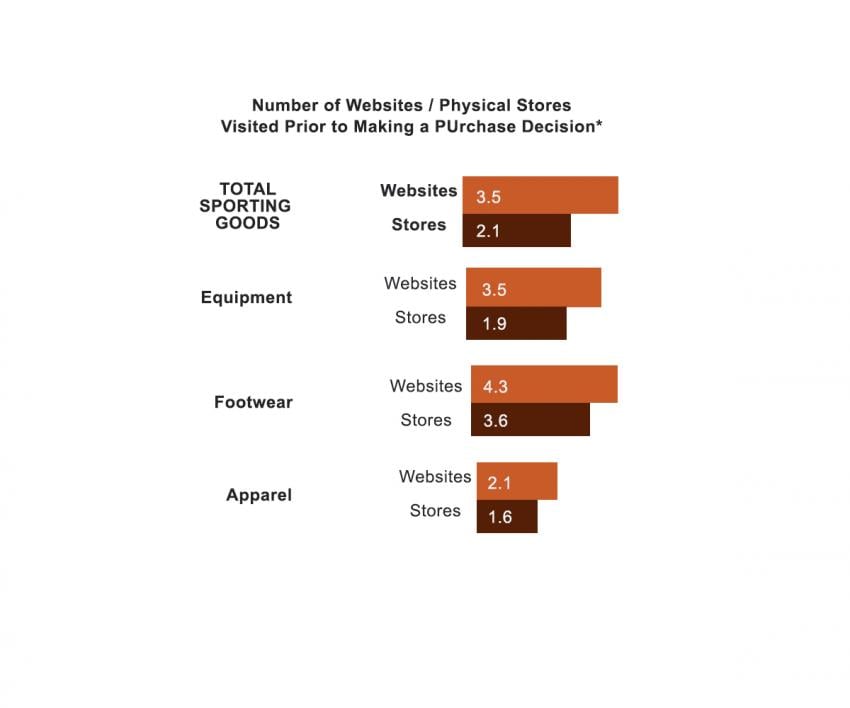

Further analysis reveals that sporting goods shoppers who go to a store to perform research visit about two stores, while those who visit a website to perform research go to between three and four websites. Footwear purchases tend to have the greatest number of websites and stores visited (about four websites and four stores) while apparel purchases tend to have the least (about two websites and one to two stores).

The final takeaway related to the planning stage is that regardless of whether or not the product is purchased in-store or online, price is always the most common piece of information sought. The priority of additional information then varies depending on whether information is being collected before going to a store, during a store visit, or prior to purchasing online. Availability of product is key when searching for information prior to going to the store, touching/feeling the product is important when in-store, and user ratings are a key part of online purchases. Other important sources of information across each of these scenarios include searching out product specifications and options.

In future blog posts, we’ll continue to break down the valuable information derived from this important study. Next up: Why shopping in physical stores is still consumers’ favorite way of purchasing and how that behavior compares with online shopping.